Almost 10% of American households are at risk of losing housing during pandemic, according to new report

Azmi Haroun | Publié le | Mis à jour le- Housing Crisis

-

Recevoir tous les articles sur ce sujet.

Vous suivez désormais les articles en lien avec ce sujet.

Voir mes sujets suivisCe thème a bien été retiré de votre compte

- The Consumer Financial Protection Bureau says nearly 10% of US households are at risk of losing housing.

- The report added that the housing crisis is, "at a level not seen since the height of the Great Recession in 2010."

- Black and Hispanic homeowners and renters have been disproportionally affected.

- Visit the Business section of Insider for more stories .

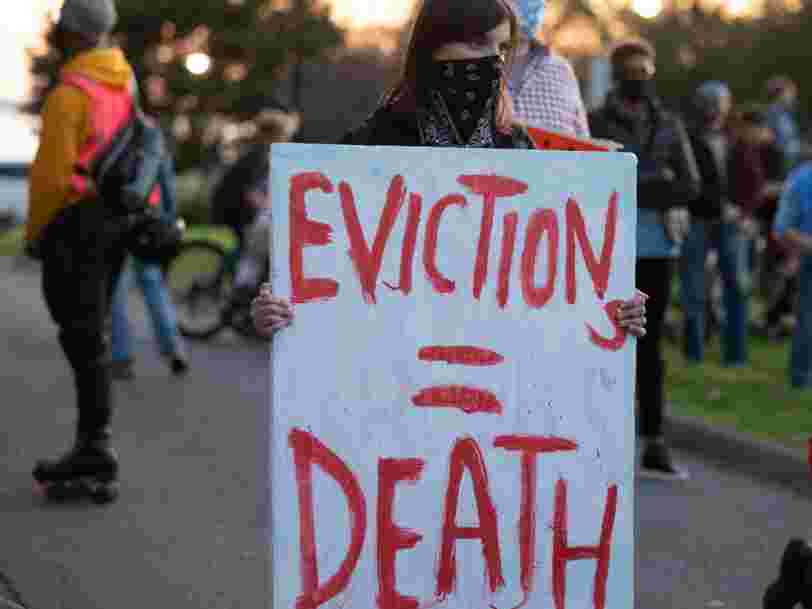

A new report by the Consumer Financial Protection Bureau highlighted that 11 million American families are at risk of eviction or foreclosure due to financial strain from the coronavirus pandemic.

That means that almost 10% of American households are at risk, according to the report. In its analysis of the housing market during the pandemic, CFPB added that around 2.1 million families are at least three months late on mortgage payments, while 8.8 million renters are late on rent.

The report also mentioned that as forbearance and eviction moratoriums expire across states and federally, the crises will likely deepen.

"We are working hard to help homeowners and renters as the US begins to turn a painful crisis, caused by the pandemic, into a robust recovery," CFPB Director Dave Uejio said in a press release . "We know small landlords are struggling, too, with many dipping into savings or using credit cards to make it through the pandemic. We want everyone - homeowners and renters, landlords, and mortgage servicers - to have the tools they need now to avoid unnecessary evictions and foreclosures."

The report added that the housing crisis is "at a level not seen since the height of the Great Recession in 2010," and that collectively American households are estimated to owe almost $90 billion.

The CFBP report also found that Black and Hispanic homeowners were more than twice as likely as their white counterparts to have accumulated late housing payments during the pandemic.

In terms of the renters market, Black and Hispanic households are more than twice as likely to be renters than white households, and the eviction crisis is disproportionately affecting those communities.

According to the report, the average late renter is over three months behind on rent, owing over $5,000 in rent and utilities. CFBP added that renters have been unable to pay a total of $44.1 billion dollars throughout the pandemic.

There are no policy recommendations in CFBP's latest report, but the agency refers to advocates calling on the government to set aside $100 billion to assist low-income renters, building on the $25 billion set aside by the federal government through the Emergency Rental Program in December 2020.

Inscrivez-vous gratuitement à notre newsletter quotidienne

Via PakApNews