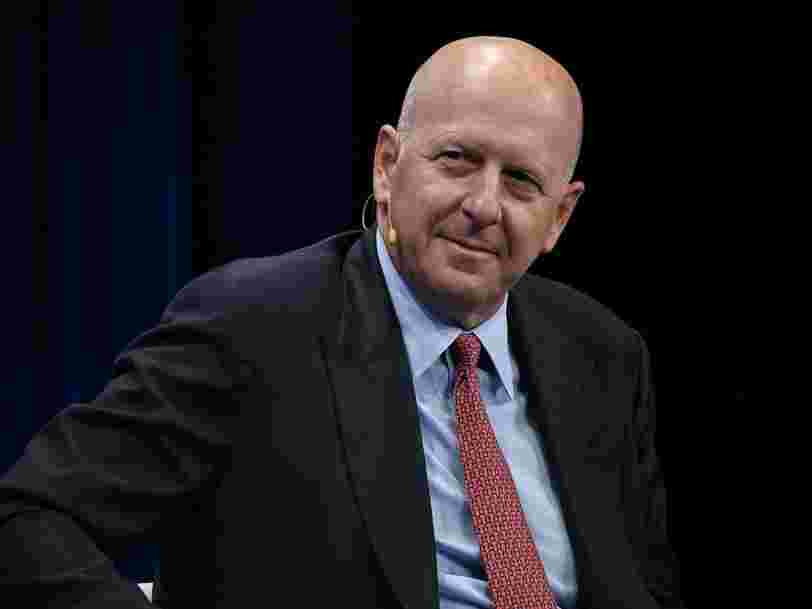

Goldman CEO David Solomon given a $10 million pay cut as punishment for firm's involvement in bribery scandal

Tyler Sonnemaker- Goldman Sachs

-

Recevoir tous les articles sur ce sujet.

Vous suivez désormais les articles en lien avec ce sujet.

Voir mes sujets suivisCe thème a bien été retiré de votre compte

Goldman recently agreed to pay more than $3 billion to US and international regulators over a criminal bribery scheme involving Malaysia's 1MDB fund.

- Goldman Sachs slashed CEO David Solomon's pay in 2020 by $10 million, or 36%, the bank said Tuesday.

- The cut was due to his role in a multibillion-dollar bribery scandal involving Malaysia's 1MDB fund.

- Goldman has paid more than $7 billion in penalties to regulators.

- Visit Business Insider's homepage for more stories .

Goldman Sachs CEO David Solomon's pay was cut by $10 million in 2020 in response to the bank's role in one of the biggest financial scandals in history, which has led to record-setting multibillion-dollar regulatory fines and multiple criminal indictments.

The pay cuts came in response to a nearly $3 billion settlement that Goldman reached with the US Department of Justice last year where it admitted it violated US anti-corruption laws by offering bribes to foreign government officials to win business from Malaysia's 1MDB fund - the largest such fine ever paid by a US firm.

Solomon's total compensation was still $17.5 million last year after accounting for the penalty, down 36% from the $27.5 million he made in 2019, the bank said in a regulatory filing Tuesday. That included a $2 million base salary, $2.65 million cash bonus, and $10.85 million in performance-related stock.

Goldman also slashed COO John Waldron's pay by $6 million, to $18.5 million, and CFO Stephen Scherr's pay by $7 million, to $15.5 million.

Goldman also faced investigations from international regulators in more than 14 countries including the US, Malaysia, Singapore, Hong Kong , and the UK. Malaysian regulators reached a $3.9 billion settlement with the bank last July, and two Goldman employees have been criminally indicted for their alleged actions.

The filing said that, while none of Goldman's three top executives were "involved in or aware of" any illicit activity by the company at the time, its board of directors "views the 1MDB matter as an institutional failure, inconsistent with the high expectations it has for the firm."

Goldman beat Wall Street expectations last quarter, bringing in $11.7 billion in revenue as pandemic-related volatility helped boost the performance of its trading desks and deal-advising business.

Inscrivez-vous gratuitement à notre newsletter quotidienne

Via PakApNews